The California Dream is Alive and Well and Living in NYC

As this winter comes to an end - people who survived the cold - fantasize about moving to somewhere warm - mainly Florida, California, or Arizona.

A recent client, who supports herself as a message therapist along with metaphysical healing work, wants to leave New York and move to San Diego. She gets by on an annual income of $25,000, working 4 days a week, rents a room in someone's house, and has no car. Isn't that below the poverty level? It is in NYC.

San Diego is one of the more expensive places in the country to live. She has no savings, nor debts, and pays her taxes. She would need at least $10,000 to make the move along with the purchase of a car. She wants to get out of New York because of the weather, having lived in Southern California many years ago and fantasizing The California Dream. She has no backup system - a must if you're making a major move.

The truth is she can't afford to move, especially as she would have to build her business there. Like most metaphysical people she believes that if you do what you love, the money will come. That's not true. Metaphysics is filled with fallacies. She is burned out - is tired of struggling and thought the universe would have provided by now. She needs a supplemental day job to save anything. But she doesn't want to work a day job and really does not have qualifications to do so. Further she is in her mid-50s which makes finding a job even harder. Can I solve her problem ... no.

I told her that she was going to move, but not to California. Then she told me she has an opportunity to rent a nice garden-style apartment for one year at a reasonable rent. I guess that is the universe - her personal grid program providing - and showing her where she belongs. I had "seen" the answer on her timeline, to what could bring her some relief, but there is no permanent solution for her problems. Then again nothing here is permanent ... it's all going away. I also told her that in the 50s, a woman should not be doing massage therapy. It should end along with menopause.

Whoops ... I forgot to mention one more thing that I really thought New Yorkers were getting beyond. She would like a nice man to share her life with - one without baggage. Aren't we over that yet? One probably has a better chance of winning the lottery in New York City. And so the women come here and cry ... and it's all very sad ... and all I can tell them in consolation is, "The program is ending." Do they get it? Doubtful.

Two things in life are certain Death and Taxes - Ben Franklin

It's tax season as many people hustle to make the April 15th deadline on a full moon lunar eclipse.

Yesterday, while driving down 4th Avenue, I stopped for a traffic light at 86th street. Just across the street was an H&R Block with senior citizens soliciting business by giving away H&R Block foil balloons while talking to people as they walked by. It looked like fun, but I also wondered about the financial status of the seniors.

On the matter of taxes ... you know the deal. It's easiest when the money is deducted from one's salary. If not we find all the scenarios that are played around the tax game. One thing I do find harsh is that here in New York, if you make a certain amount of money, 50% of it goes to taxes. Bummer.

Most of my clients, who are in debt, do not owe the IRS. They owe credit cards, or both personal and student loans.

If you get a refund from the IRS this year, think about what you want to do with it. Do you want to be a little frivolous? Is it better to pay debts or save the money for a rainy day? If you own a home you have to assume a certain amount will go for repairs every year. Electrical appliances always have to be updated. Cars get to a point where they can't be fixed. In other words, if you get a refund, pause and think about what has to be updated in your life to keep it in balance. Sometimes necessity overrides luxury.

4 ways scammers can steal your tax refund CNN - April 9, 2014

Identity thieves love tax season. "A thief who has your personal information can file a tax return before you do, collect a fraudulent refund and leave you waiting for many months to get your own refund and clear up the problem," said Neil Chase, vice president of education at LifeLock. And it's only getting worse. Last year, the IRS launched 1,492 investigations into tax-related identity theft, where criminals used stolen personal information like Social Security numbers to claim fraudulent refunds. That's up 66% from 2012 and more than 400% from 2011.

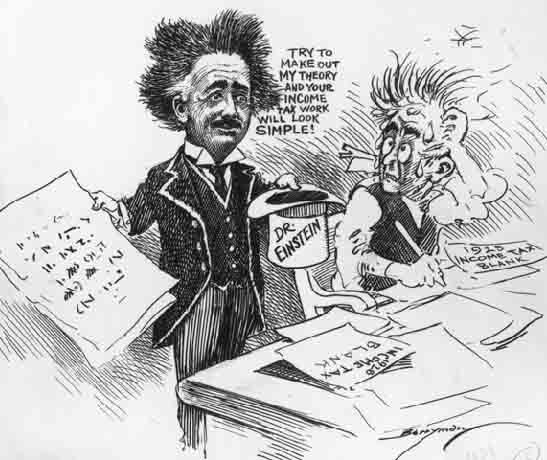

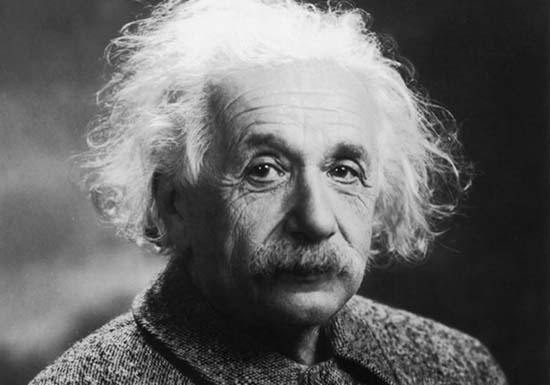

The hardest thing in the world to understand is the income tax.

This is too difficult for a mathematician. It takes a philosopher.

Albert Einstein

do with it. Scrap it, kill it, drive a stake through its heart, bury it

and hope it never rises again to terrorize the American people.

Steve Forbes

doesn't get worse every time Congress meets.

Will Rogers

and tax revenues are too low, and the soundest way to

raise the revenues in the long run is to cut the tax rates.

John F. Kennedy

standing in a bucket and trying to lift himself up by the handle.

Winston Churchill